Ethereum’s network dynamics are shifting in a way that could reshape its market structure. On-chain data shows that roughly 30% of all Ethereum (ETH) supply is now locked in staking contracts, marking a record high for the protocol’s proof-of-stake ecosystem.

Related Reading: Bitcoin Is ‘No Longer Digital Gold,’ Deutsche Bank Strategist Says

Even as ETH prices have struggled, trading below the $2,000 level in recent sessions, activity around staking continues to rise. According to analytics data, about 36.6 million ETH is currently staked, meaning a significant portion of the circulating supply is effectively removed from liquid markets.

The increase in staked supply appears to be driven in part by institutional and whale accumulation. Large entities such as BitMine and others have been adding to their staked holdings, while smaller wallets have also shown interest in locking up ETH for validator rewards.

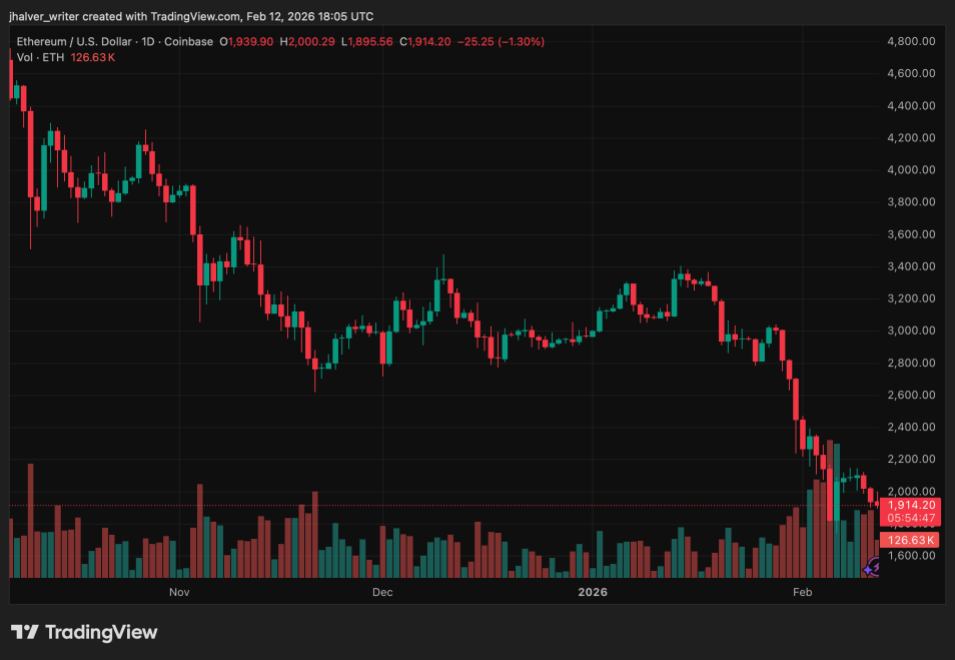

ETH's price trends to the downside on the daily chart. Source: ETHUSD chart on Tradingview

Ethereum Staking Demand and Supply Impact

The record staking ratio, now above 30% of total supply, shows a structural change in Ethereum’s supply dynamics. Validators locking ETH must commit to long lead times before withdrawing, and the current exit queue remains minimal relative to new stakes.

From a liquidity perspective, staking removes tens of billions of dollars worth of ETH from active circulation. Reduced liquidity could amplify price moves if demand resurges, but it also raises questions about near-term volatility amid current macroeconomic conditions and broader crypto market pressures.

Recent price weakness has seen ETH trade below key support levels, with analysts noting a mix of technical vulnerability and potential for renewed accumulation at lower levels.

Whale behavior also underscores this theme. On-chain metrics show that larger holders have been modifying their exposure, with some reducing reserves while others increase positions, particularly via staking channels that minimize selling pressure.

Market Outlook on ETH Price Amid Locked Supply

Ethereum’s price action remains sensitive to broader market drivers, including macroeconomic data and liquidity flows within the crypto sector. However, the growing share of staked ETH alters the supply picture: with nearly one-third of tokens locked, immediate sell pressure may be constrained.

Analysts suggest that this supply tightening, combined with whale accumulation, could play a significant role in price behavior if market sentiment shifts.

Related Reading: Bitcoin Buying Spree May Continue With New Preferred Stock Plan: Strategy CEO

The convergence of record staking levels and targeted accumulation creates a backdrop in which Ethereum’s fundamental network engagement strengthens even as prices lag, setting the stage for a potentially different phase in the asset’s market cycle.

Cover image from ChatGPT, ETHUSD chart on Tradingview